The four main ways to account for inventory are the specific identification, first in first out, last in first out, and weighted average methods. As background, inventory includes the raw materials, work-in-process, and finished goods that a company has on hand for its own production processes or for sale to customers. Inventory is considered an asset, so the accountant must consistently use a valid method for assigning costs to inventory in order to record it as an asset.

The best home inventory apps will make it easy and intuitive to categorize your possessions. You can scan barcodes and QR codes for easy retrieval of product details. Inventory your home or business possessions rapidly with this easy to use app! Capture images using the camera capabilities of any windows device and add item names and descriptions. Sep 16, 2020 A home inventory app is an app that keeps track of all of the inventory in your home. It accounts for all the items in your home and keeps them organized in an app that you can access on the go. It lists all of your possessions in one place, keeps them secure, organized, and even has a place where you can total up the value of all your items.

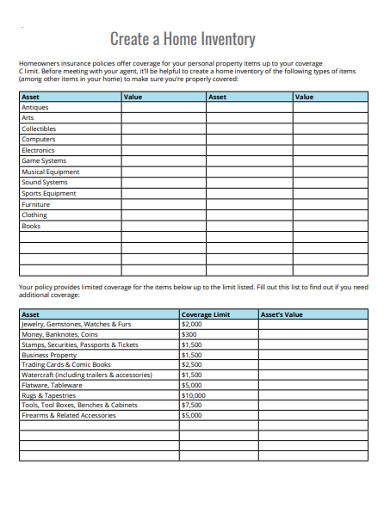

- A home inventory can be as simple as a list of all your possessions or a visual record for each item, but an effective home inventory should include both for added security. Today, there are even digital tools to help simplify the process of maintaining the list.

- The devastation of losing your home and possessions is unthinkable and can cause an incredible amount of stress in itself. Ideally you'll never need to file a homeowner's insurance claim. However, an updated inventory can make the process faster and easier, and help you get the most from your insurance.

The valuation of inventory is not a minor issue, because the accounting method used to create a valuation has a direct bearing on the amount of expense charged to the cost of goods sold in an accounting period, and therefore on the amount of income earned. The basic formula for determining the cost of goods sold in an accounting period is:

Beginning inventory + Purchases - Ending inventory = Cost of goods sold

Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. There are several possible inventory costing methods, which are:

Specific identification method. Under this approach, you separately track the cost of each item in inventory, and charge the specific cost of an item to the cost of goods sold when you sell the specific item to which that cost has been assigned. This approach requires a massive amount of data tracking, so it is only usable for very high-cost, unique items, such as automobiles or works of art. It is not a viable method in most other situations.

When you buy inventory from suppliers, the price tends to change over time, so you end up with a group of the same item in stock, but with some units costing more than others. As you sell items from stock, you have to decide on a policy of whether to charge items to the cost of goods sold that were presumably bought first, or bought last, or based on an average of the costs of all items in stock. Your choice of a policy will result in using either the first in first out method (FIFO), the last in first out method (LIFO), or the weighted average method. The following bullet points explain each concept:

First in, first out method. Under the FIFO method, you are assuming that items bought first are also used or sold first, which also means that the items still in stock are the newest ones. This policy closely matches the actual movement of inventory in most companies, and so is preferable simply from a theoretical perspective. In periods of rising prices (which is most of the time in most economies), assuming that the earliest units bought are the first ones used also means that the least expensive units are charged to the cost of goods sold first. This means that the cost of goods sold tends to be lower, which therefore leads to a higher amount of operating earnings, and more income taxes paid. Also, it means that there tend to be fewer inventory layers than under the LIFO method (see next), since you will continually use up the oldest layers.

Last in, first out method. Under the LIFO method, you are assuming that items bought last are sold first, which also means that the items still in stock are the oldest ones. This policy does not follow the natural flow of inventory in most companies; in fact, the method is banned under International Financial Reporting Standards. In periods of rising prices, assuming that the last units bought are the first ones used also means that the cost of goods sold tends to be higher, which therefore leads to a lower amount of operating earnings, and fewer income taxes paid. There tend to be more inventory layers than under the FIFO method, since the oldest layers may not be flushed out for years.

Weighted average method. Under the weighted average method, there is only one inventory layer, since the cost of any new inventory purchases are rolled into the cost of any existing inventory to derive a new weighted average cost, which in turn is adjusted again as more inventory is purchased.

Both the FIFO and LIFO methods require the use of inventory layers, under which you have a separate cost for each cluster of inventory items that were purchased at a specific price. This requires a considerable amount of tracking in a database, so both methods work best if inventory is tracked in a computer system.

Related Courses

Accounting for Inventory

How to Audit Inventory

Managing your IT is moments away from getting a heckuva lot easier. Devices, software, cloud services, user info—check, and there's even more: find insights quickly, automate your scans, customize your reports. Like a boss. We hope your network is ready. Or networks—got multiple remote sites, clients, activities you need to service? Done. Wasn't that easy?

Once your download is complete, you can follow the easy instructions below to get it up and running. Don't stop there, though: below you'll find a number of resources we've hand-picked from our Knowledge Base and community to make sure your inventory use is easy and quickly meets the needs of your organization.

Start Scanning in 3…2…1

- Run the Spiceworks installer.

- Launch the app.

- Login or register for Spiceworks.

Minimum system requirements for inventory.

- Windows 7, Windows 8, Windows Server 2008 R2 or Windows Server 2012 R2

- 1.5 GHz Pentium 4 class processor

- 4 GB RAM

Cloud Help Desk

1200+ Ratings

Start Scanning in 3…2…1

- Run the Spiceworks installer.

- Launch the app.

- Login or register for Spiceworks.

Minimum system requirements for inventory.

- Windows 7, Windows 8, Windows Server 2008 R2 or Windows Server 2012 R2

- 1.5 GHz Pentium 4 class processor

- 4 GB RAM

Cloud Help Desk

1200+ Ratings

Launch a fully-loaded help desk in minutes to manage whatever users throw your way.

Home Inventory 3 7 5 – Easily Inventory Your Possessions Like

Inventory Management

Discover the technologies in use within your organization. Device Inventory. Software tracking. Customized Reporting.

Connectivity Dashboard

Stay on top of application connectivity. Quickly check ISP, find impacted users, and narrow down the culprit.

Home Inventory 3 7 5 – Easily Inventory Your Possessions For A

Spiceworks Community

Millions of IT experts.

Thousands of tech vendors.

One place.

Home Inventory 3 7 5 – Easily Inventory Your Possessions Like

THE most trusted tech community around. Get fast answers to your IT questions, research vendors and products, and level up your IT game.